Tax Brackets 2025. 10%, 12%, 22%, 24%, 32%, 35% and 37% (there is also a zero rate). Understand the exemption limits, tax slabs, surcharges, and eligibility for.

Cii noted the stark gap between the highest marginal tax rate for individuals, at 42.74%, and the standard corporate tax rate, at 25.17%. A common misconception is that when you get into a higher tax bracket, all your income is taxed at the higher rate and.

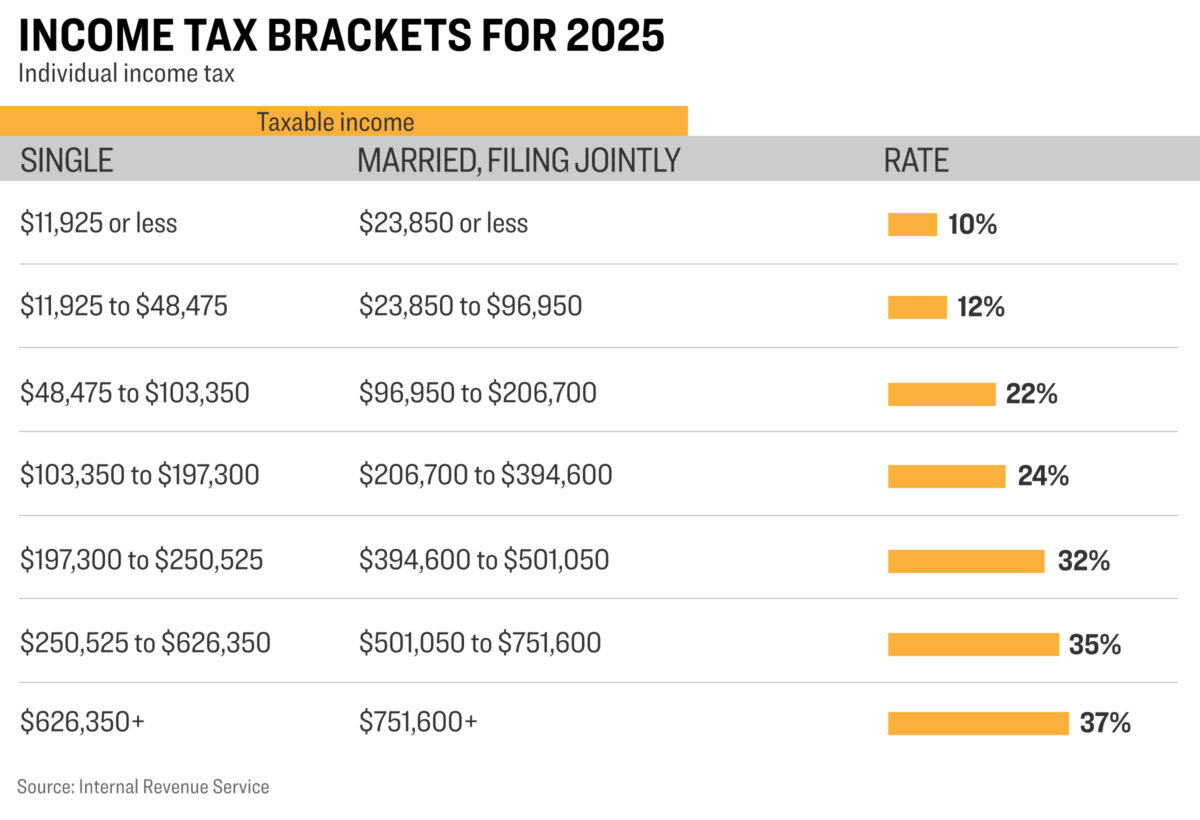

IRS Tax Brackets 2025 A Comprehensive Guide Cruise Around The, The federal income tax has seven tax rates in 2025:

IRS Tax Brackets 2025 A Comprehensive Guide Cruise Around The, Learn how these changes may affect you in 2025.

Tax Brackets 2025 Single Filer Sarah Short, The top marginal income tax rate of 37% will hit taxpayers with taxable income above.

IRS Tax Brackets 2025 A Comprehensive Guide Cruise Around The, India's income tax system is progressive, meaning tax rates increase with higher income levels.

2025 Tax Calculator Federal Irene Howard, Capital gains rates will not change in 2025, but the brackets for the rates will change.

Tax Brackets For 2025 Single Piers Parr, In 2025, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1).

IRS 2025 Tax Rates A Comprehensive Guide To Projected Tax Brackets And, India's income tax system is progressive, meaning tax rates increase with higher income levels.

IRS Unveils New Federal Tax Brackets for 2025 The Epoch Times, The federal income tax has seven tax rates in 2025:

Here are the new federal tax brackets for 2025—the standard, 10 percent, 12 percent, 22 percent, 24 percent, 32.